Tax policy is at the center of legislative discussions in preparation for the 2025 Session. The conversations are fueled by the potential property tax elimination measure and pressures to improve the tax system. Interim legislative committees recently met and discussed tax exemptions along with impacts of potential limitations on local political subdivision budgets and levies.

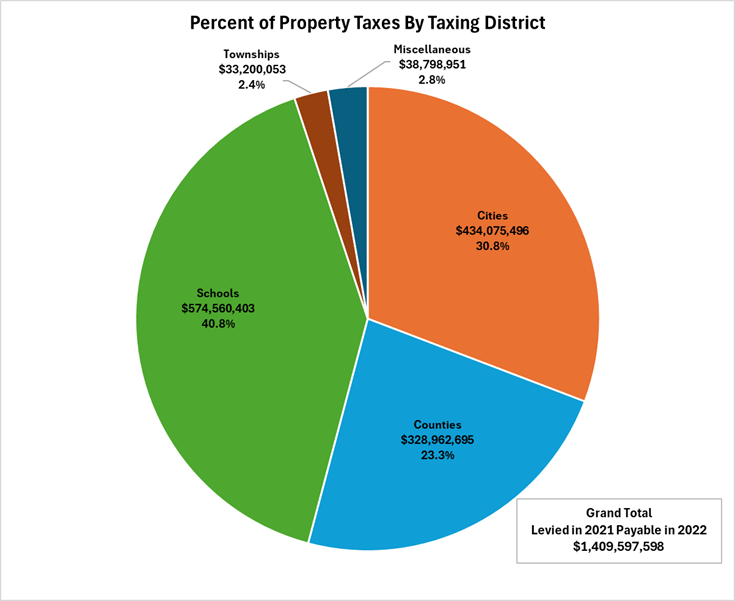

In preparation, NDACo dove into county property tax data, which provides accurate information on the level of taxation, changes to those amounts and how counties are using those dollars. The total amount of property taxes levied in ND in 2022 was $1.4 billion with counties levying 23% of the total property taxes.

When looking at property values, the information isn’t separated out by taxing district but is representative of statewide values for all property classes. From 2019-2022 property values have increased 11% or an average of 3.6% each year.

“Property values going up reflects growth, that’s a good thing. But when values increase because of growth and development so does the increase in need for services,” said NDACo Executive Director Aaron Birst. “Counties are very much opposed to capping any kind of value increases. It is our opinion that would be a disaster and cause inequities between homeowners that in the long haul, citizens would not appreciate. As you look for solutions, caps on valuations are not the way to go.”

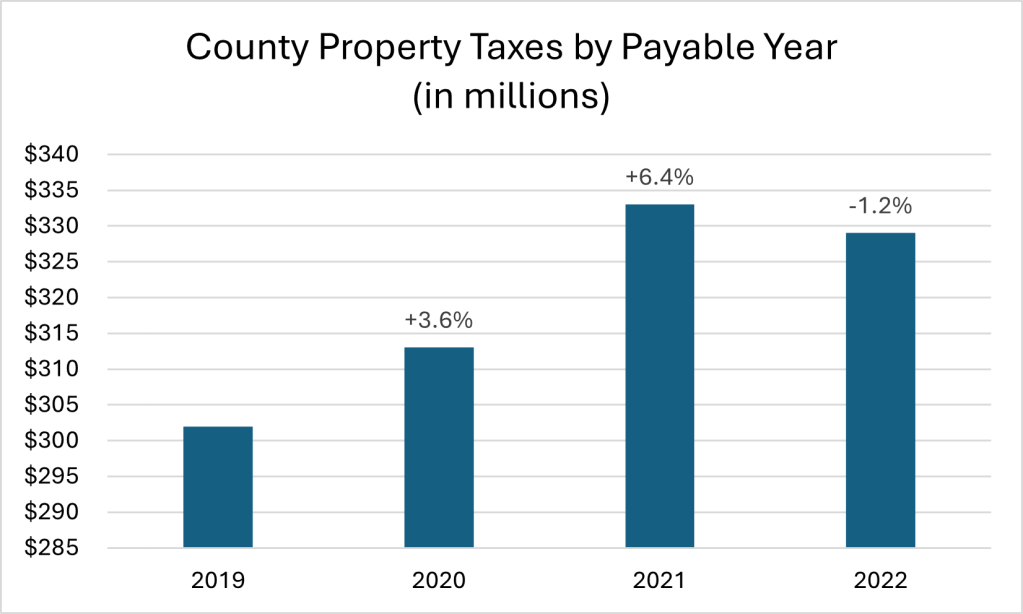

Just because values went up does not mean property tax and county budgets increased. Counties, on average since 2019, saw a 3% increase in growth. “What county folks don’t get credit for is that there were counties that reduced their budgets. In fact, from 2021 to 2022 counties saw a decrease of 1.2% in property taxes collected,” Birst explained. It’s also important to note that during that same time frame the Consumer Price Index grew from 4.7% to 8%.

WHAT DO COUNTIES PAY FOR?

One-third of county expenses are funded by property taxes. Nearly half of county expenditures are dedicated to roads and public safety.

CITIZENS APPROVE MEASURES TO INCREASE TAXES

Despite what many may think about North Dakotans’ view of property taxes, recent measures on the ballot to increase taxes to pay for specific local services illustrate that citizen’s support. In the 2022 and 2024 election cycles, there were 57 county measures on the ballot to approve additional or increasing levies. 52 of the 57 measures passed, that’s a 91% approval rating. This strongly signifies that if citizens believe the service benefits their community, they support it.

PROPERTY TAX EXEMPTIONS

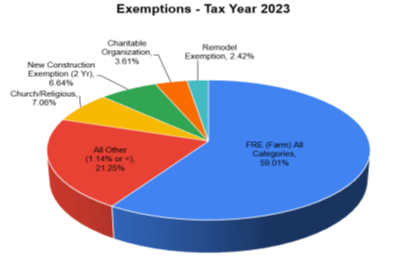

NDACo was also asked to provide information on property exemptions. A survey was sent to all County Tax Directors, 52 out of the 53 counties responded. Throughout the state there are 25,000 parcels that are exempt from paying taxes. NDACo traditionally has opposed expanding property tax exemptions as these exemptions spread the tax burden to other taxpayers in the county. Of note, the data shows nearly 60% of the exemptions are farm related.

Other interesting findings are:

- Cass County has the highest number of exempt parcels at 3,031

- Renville County reported the fewest number of exempt parcels at 124 (121 are farm related)

- New Construction/New Business exemptions account for 50% of total count in Cass County

- 73% of Stutsman County’s exemptions are farm related

- Walsh County reported the highest number of Charitable Organization exemptions

Link to view the survey results HERE

FURTHERING TAX RELIEF & POLICY CHANGES

NDACo has been asked about caps to valuation along with limiting the growth of property taxes collected and budgets and what the impacts would be on counties. Birst explained that when considering caps as a potential mechanism, it’s realistic that most political subdivisions will take that percentage every year regardless of whether they need to or not because the next year is unknown. In addition, because counties are not equal in population, economic activity or budget, a percentage cap is going to impact counties differently. “Caps may not be the answer in satisfying those who are upset with property taxes,” said Birst.

Leading up to the 2025 Legislative Session this discussion is sure to continue. There are many ideas and thoughts on potential tax relief and policy changes. NDACo has been involved in numerous discussions with legislators, other associations representing political subdivisions and the business community on these concepts. NDACo will continue to partner in these discussions to improve the system.

It’s also important to highlight the significant relief approved in the 2023 Legislative Session. Lawmakers approved a $500 property tax credit for primary residences, expanded the homestead tax credit by increasing eligibility for those 65 and older and reduced the state’s income tax. The Tax Foundation recently reported that North Dakota had the 7th lowest state-local tax burden in the nation in 2022.