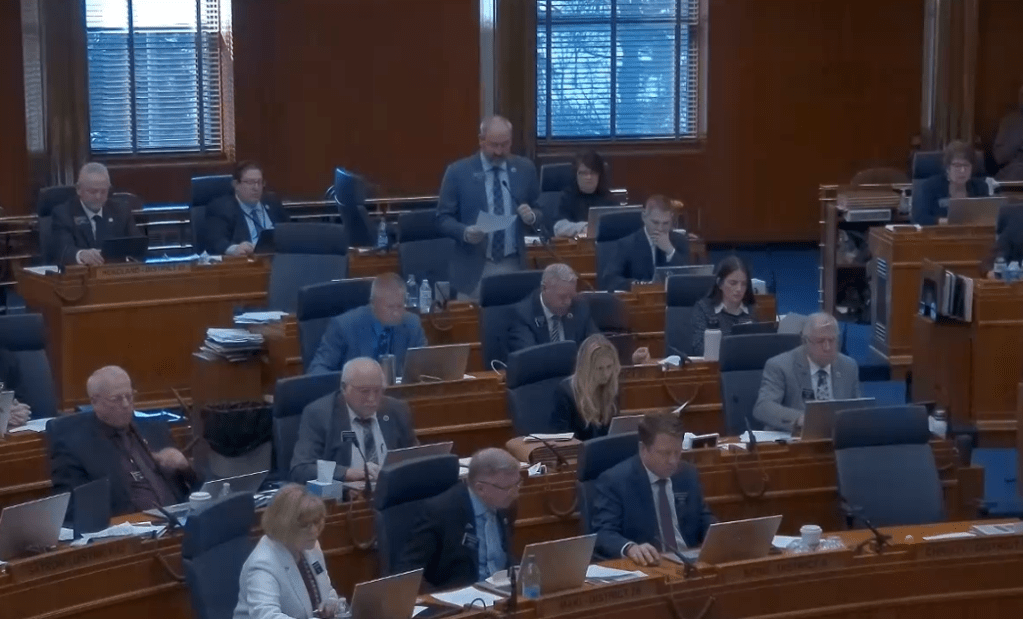

In a somewhat rare move, House members Tuesday requested to debate amendments on HB 1176. HB 1176 is the property tax relief and reform bill sponsored by Rep. Nathe to provide a $1450 primary residence credit and caps local government limits property taxes at 3% growth. More detail about what is included in the bill was provided in a previous legislative blog post.

Rep. Ben Koppelman of West Fargo wanted to debate amendments included in two specific sections of the bill. He criticized the flexibility provided to political subs in relation to the cap on property tax revenues. The amendments he singled out for debate allow political subdivisions to vote to exceed the cap for two years as well as the ability for counties and cities to ask for voter approval to override the cap, good for 10 years. After plenty of debate, House members voted to keep the flexibility to exceed and opt out of the cap in HB 1176.

The other amendment debated was a section added to include income tax relief, increasing the income threshold for the bottom, zero bracket. The House did vote to remove that section of the bill.

HB 1176 will now go to House Appropriations before returning to the House Floor for another vote on the bill in its entirety. We encourage you to let your Representatives know the reasons why any reform measures need to allow for some level of local control.

Listen to the House debate on the amendments here

Click here to review a status update on property tax relief/reform bills