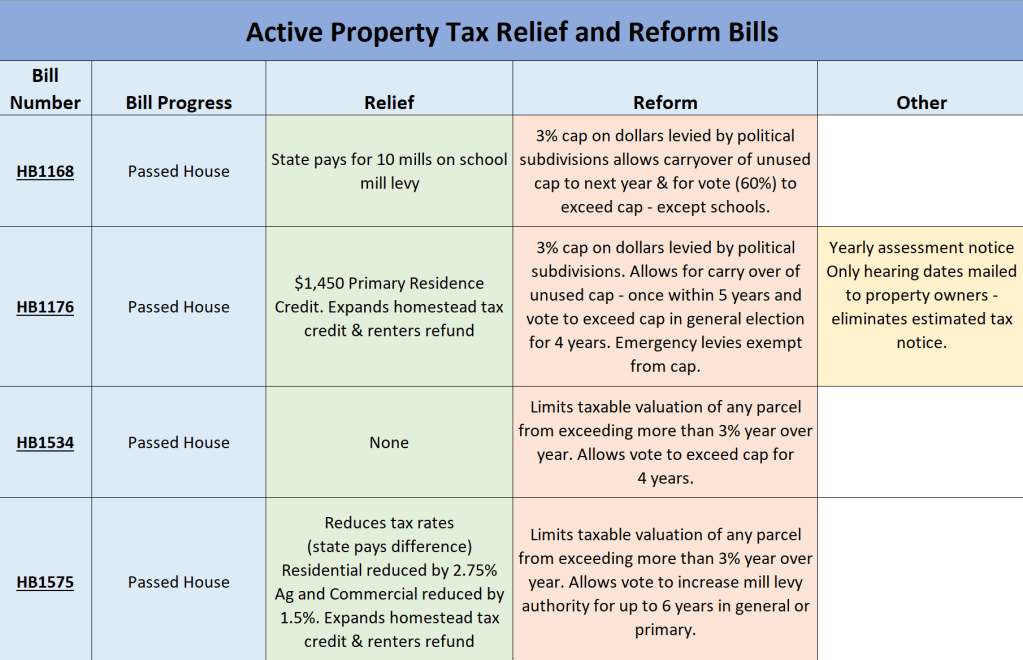

Two of the major property tax relief / reform bills had hearings Tuesday. HB 1168 buys down 10 mills of property taxes using the school funding formula and places a 3% cap on dollars levied for all political subdivisions except schools. NDACo suggested a restriction based on the Consumer Price Index plus 2% would be preferred over a 3% flat cap. HB 1168 does allow to carry over unused cap to the next year and allows for a vote to exceed the limitation. The Senate Finance & Taxation committee also received testimony on HB 1575 which reduces the tax rate on all property classes including centrally assessed and includes a 3% cap on taxable valuation. While the bills vary in how they restrict local government they both provide relief to all property taxpayers, which is appealing to some lawmakers. During both hearings the bill sponsors did suggest amendments. The committee did not act on these bills as the other major property tax bill is scheduled for Monday. HB 1176 provides $1450 in relief for primary residents only through the primary residence credit. It also includes a 3% cap on dollars levied but also allows for a vote to exceed the cap and allows for carry-over. HB 1176 will be heard Monday, March 17th at 9 a.m. in the Senate Finance & Tax committee. It is uncertain at this point if the committee will want to amend any of the bills and choose one as the favorite to pass out of the Senate. NDACo will be monitoring the committee work on these bills very closely.

Other important action this week:

- NDACo testified in opposition to SB 2039 which would provide a property tax exemption to Agriculture storage facilities on the basis that these tax exemptions shift the tax burden to other property taxpayers.

- SB 2365 sought to prohibit judges from waiving 24/7 fees, an action that is being done in some counties and impacts the associated costs for this program which is intended to be self-funded. SB 2365 had a hearing, received a Do Not Pass recommendation and was defeated in the House. The bill had been supported by the Sheriffs.

- HB 1096 which decreases the 911 service fee to provide additional revenues to support the 911 program received final passage in the Senate.

- SB 2098 also received final passage and changes the criteria used to issue Silver Alerts.

- SB 2183 which increases fines in construction zones was passed out of committee but amended to only include the fine when workers are present in a construction zone.

- HB 1518 relating to rotary traffic islands (round abouts) came out of committee with a DNP as it is a duplicate bill of SB 2371, which already passed both houses.

- HB 1153, which passed both houses, clarifies exemptions for one-call notices for normal maintenance of paved roads as long as it does not extend deeper than existing pavement and normal surfacing of gravel roads, as long as the maintenance does not involve the road ditch.

- SB 2281 which would have increased the tobacco tax, failed in the House.

Click here to view the hearing schedule of bills NDACo is tracking