As NDACo analyzes the first period of the 69th Legislative Session, the word “challenging” comes to mind. There seems to be a strong sentiment to restrict local government this session. It has been a challenge for county officials and NDACo legislative staff to navigate explaining the importance of local control and the difficulty counties will have in responding to local needs when revenues are restricted.

A total of 1,020 bills and 63 resolutions were introduced this Session, the highest since the 2009 Session. Lawmakers passed 69% of the bills introduced, meaning 710 bills have crossed the hall to the opposite chamber. This indicates there is going to be a heavy lift to whittle the number of bills down, especially those with an appropriation. NDACo started the Session tracking 600 of the bills introduced and after crossover we are still involved in monitoring and acting on 425 bills that are county related. The following is a summary of some key topics and priority bills.

PROPERTY TAX RELATED

Lawmakers came into the Session with a strong desire to provide significant property tax relief. During the 2023 Legislative Session, the Legislature approved a $500 credit for primary residences. All bills being considered increase the amount of relief to taxpayers and many of them expand who would receive relief. At the same time, the momentum behind legislation to restrict local government’s ability to raise taxes has grown.

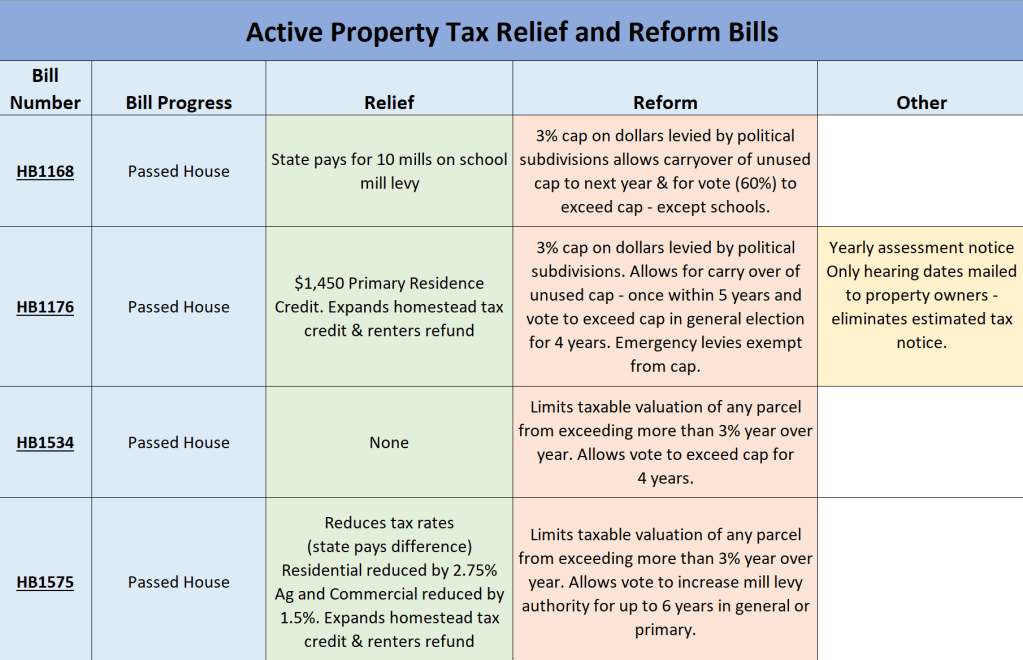

We started the Session with approximately 60 different property tax-related bills that included relief and reform measures. The Senate killed all their proposals; the House passed over four bills, three of them being packages that include both relief and limitations to local budgets, or caps.

Here is a summary of the remaining property tax-related bills as they crossed over from the House:

HB 1176

- Relief: provides $1,450 primary residence credit, increases threshold to qualify for the homestead credit and increases renter’s credit. Total of $503 million in relief.

- Reform: 3% cap on dollars levied with allowances to carry over unused caps and exceed the cap with voter approval.

HB 1168

- Relief: 10 mill buydown on school mills, relief to all property owners. Total of $120 million in relief.

- Reform: 3% cap on dollars levied with allowances to carry over unused caps and exceed cap with voter approval.

HB 1575

- Relief: Reduces tax rates on residential, agricultural, commercial. Expands threshold to qualify for homestead credit and increases renter’s credit. Total of $703 million in relief.

- Reform: 3% cap on taxable values. Allows for voter approval to increase mills above levy limit.

HB 1534

- Relief: None provided

- Reform: 3% cap on taxable valuation, allows to exceed cap by specific percentage with voter approval.

It is uncertain at this point what the Senate Finance and Taxation Committee’s appetite is for amending or combining these bills. Although we believe the Legislature will ultimately regret going down the cap road, it appears caps are on their way. Because of the strong position of the Legislature to restrict local spending, the strategy has now shifted to asking for lawmakers to lighten the cap to avoid severe consequences of diminished local services. NDACo is encouraging lawmakers to consider an indexed cap based on the Consumer Price Index (CPI) + 2% to account for high inflation years, as a better option over a flat 3% cap.

SB 2201 was the first bill signed into law. It allows primary residences owned by qualifying trusts to retroactively apply for the 2024 primary residence credit and to be eligible in the future.

A few bills were introduced to address levies that don’t directly impact local property; however, these true reform measures were unsuccessful. HCR 3012 and SCR 4023 were resolutions to allow voters to repeal the one mill for the state medical center with the intent of the state to fund the medical center through a direct appropriation ($15 million/biennium) versus an expense to local property taxpayers. Both these resolutions failed. HB 1572 was introduced to eliminate local levies for Garrison Diversion and NDSU Extension, again with the intent of shifting financial responsibility to the state. Those portions were removed from the bill. The bulk of HB 1572 now includes changes to the tax statement – PASSED

TRANSPORTATION RELATED

The NDDOT Budget (SB 2012) includes new funding for local roads and bridges. Funding concepts from three separate infrastructure bills were rolled into the DOT Budget Bill in the Senate. The greatest policy change is dedicating 100% of the motor vehicle excise tax to roads and bridges. This package includes additional funding and will have a positive impact on funding local road needs.

Here is a summary of what is included in the bill:

- Flexible Transportation Fund grows to $447 million

- 100% of the motor vehicle excise tax ($360 million)

- 1% of Legacy Fund Earnings ($87 million)

- 50% of Flexible Transportation Fund to NDDOT ($223 million)

- 50% split into six buckets for local roads and bridges ($223 million)

- Non-oil County and Township Roads and Bridges ($56 m)

- County and Township Bridges ($56 m)

- County and City Formula Distribution ($28 m)

- Non-oil Township Formula Distribution ($28 m)

- Non-oil Township Grants ($28 m)

The House approved a gas tax increase to help fund local roads. HB 1382 increases the gas tax $0.03 and generates an estimated $43 million to be distributed to non-oil counties, cities, and townships.

The Prairie Dog bucket got a nice addition in the OMB Budget Bill (HB 1015), increasing it from $170M to $220M. This is to keep distributions whole if SB 2397 passes. SB 2397 re-defines low-oil producing counties as non-oil producing. There are five counties and 187 townships this would impact. The $50 million in additional Prairie Dog funds in HB 1015 would ensure distributions to cities, counties and townships would not decrease. In addition, House Appropriators decreased the amount deposited into the Strategic Investment and Improvements Fund that sits ahead of the Prairie Dog buckets from $400 million to $270 million. This would decrease the amount of oil and gas production tax revenue that is required to be deposited in other priority buckets prior to reaching non-oil counties, townships and cities. It is important to note that during a recent legislative revenue forecast, the state is predicting that the prairie dog buckets will likely not fill in the 25-27 biennium.

Other important transportation bills that have passed: HB 1444 allows counties to add township roads to the county system if it is determined a local road meets the criteria in the county road system definition. SB 2183 increases the violation fee of speeding in construction work zones from $80 to $150. The speed limits must be followed even if construction workers are not present in the construction zone.

The House defeated HB 1407 which would have increased weight limits for vehicles on the state and local roads from 80,000 to 113,000 pounds. The Senate defeated SB 2208, which would have penalized counties/townships that passed an ordinance or policy that exceeded state statute to restrict agriculture or energy infrastructure projects by prohibiting them from receiving Prairie Dog funding.

PUBLIC SAFETY RELATED

Several priority public safety-related bills are still in play as we enter the second period of the Session, even if they have been amended. NDACo worked with several legislators to introduce bills to address jail funding. HB 1197 and HB 1213 have both been amended but will provide some relief to those counties looking at jail improvement projects. HB 1197 was turned into a study of correctional needs, and HB 1213 is intended to dedicate $50 million in low-interest loans for jail improvements. HB 1344 was approved to clarify that NDDOCR will reimburse counties for housing state-sentenced inmates when the state system is experiencing overcrowding.

The Attorney General’s Truth in Sentencing bill, SB 2128, which forces violent offenders to serve a greater portion of their sentences in prison, has passed over to the House.

Several bills focused on rewarding those in public safety have found success. HB 1193 has been amended to mirror the Back the Blue Grants approved in the 2023 Session to provide $3.5 million in recruitment and or retention bonuses to local law enforcement and corrections officers. HB 1419 would allow 9-1-1 dispatchers and EMS to enroll in the NDPERS public safety plan, if their county offers the plan. SB 2093 expands the income tax deduction for retired law enforcement to surviving spouses. The Senate turned SB 1371 into a study of health insurance for retired peace officers.

Here are a few other public safety bills worth noting:

SB 2277: Designates Highway 200 as ND Fallen Peace Officers Highway – FINAL PASSAGE

SB 2098: Improvements to criteria for issuing Silver Alerts – PASSED

SB 2365: Prohibits judges from waiving 24/7 fees – FAILED

FINANCE/ELECTION RELATED

Auditors of course are closely watching the property tax-related legislation and the technical aspects of those bills that will impact budgeting, statements, notices, etc. A success was the defeat of HB 1384 which sought to require that the county auditor be elected, along with the defeat of HB 1306 which would have expanded the number of free hours to respond to open record requests from one to 40 hours. This bill met heavy opposition from county officials. An effort to reduce publication requirement for counties failed in the House with the defeat of HB 1380.

A handful of election-related bills were introduced, all those of concern were defeated:

- HB 1587: Related to post-election audits and required ballots to be hand counted

- HB 1287: Established voter registration

- SB 2178: Required separate ballots for each party for the primary election

PUBLIC HEALTH RELATED

Local public health units will continue to seek an additional $2 million dollars for a total of $10 million in state aid funding in the Department of Health and Human Services Budget, HB 1012. State aid funding is critical, flexible funding assistance to fill gaps and cover the many responsibilities local public health units have that aren’t earmarked through designated funding. This funding increase is especially important with the threat of the state mandating local government budget restrictions.

Two septic system bills were introduced on each side and both passed. HB 1541 moves to the Senate with support from local public health units, the plumbing board and environmental health practitioners. Authority to create rules related to licensing, permitting, and inspecting septic systems lies within the Department of Environmental Quality (DEQ). SB 2267 places licensing and oversight of septic systems with the plumbing board which continues to oppose “private sewage disposal systems” oversight, stating it is a separate discipline from plumbing.

Data collection from the Youth Tobacco Survey and Youth Risk Behavior Surveillance System (YRBSS) are at risk in SB 2105 which was passed in the Senate. Currently, these two data sources are the only two of their kind and offer insight into areas such as dietary behaviors, sleep, mental health issues, tobacco/vaping use, safety concerns, and physical activity. Questions for the YRBSS survey are selected through a committee of stakeholders including HHS Public Health, HHS Behavioral Health Division, DPI, DOT, Community Organizations and Regional Education.

Other public health-related bills worth noting:

- SB 2308: Removes the Onsite Wastewater Technical Review Committee and moves authority to create septic system rules to DEQ – PASSED

- SB 2281 and HB 1570: Proposed increases to tobacco tax – FAILED

- SB 2255: Pertains to qualifications, term, and duties of the state health officer – PASSED

OTHER BILLS OF COUNTY IMPORTANCE:

- HB 1602: Allow political subdivisions to opt out of NDPERS defined contribution plan – PASSED

- HB 1096: Reduce 9-1-1 service fee to 2.5%, returning additional funds to support 9-1-1 system – FINAL PASSAGE

- HB 1310: Eliminate fees for defendants, which would have reduced the amount of dollars going into the court improvement grants – FAILED

- HB 1141: Prohibit state or political subdivisions engaging in activities with member associations that endorse ballot measures – FAILED

- SB 2039: Property tax exemption for ag storage facilities – PASSED

There is still a lot of important work to do! For bills that have crossed over, this is the last chance to weigh in to make changes or encourage their passage or defeat. If the bills are altered by the second chamber at all, they may go to conference committees where lawmakers from both sides will work on a compromise.