Click here for a view of the schedule of hearings for the week of February 17th. Click here to view all bills NDACo is tracking.

Legislature Narrows Down Property Tax Relief and Reform Measures

It was a busy week of committee work as policy committees spent their time wrapping up their work on bills they have heard and passed out of committee. The first priority for policy committees was acting on bills with appropriations as the deadline for those bills to get referred was Monday. The Finance & Tax committees passed out the property tax relief and reform bills that have been proposed. We now have a greater understanding of which options are moving forward. The options out there vary greatly on how they propose to deliver relief and reform.

Here is a summary of the bills that have received Do Pass committee recommendations and have been referred to Appropriations. We expect that they could be voted on this week.

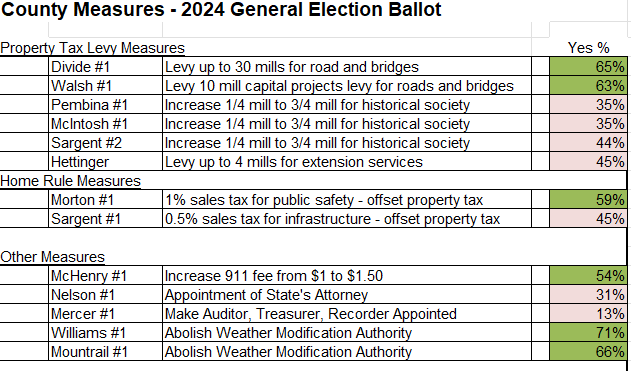

- HB 1176 – Relief: $1450 Primary Residence Credit. Reform: 3% cap on property tax dollars. Allows counties to exceed or opt out of the cap with a vote in the general or primary election.

Will be heard in House Appropriations Monday 2/17 at 3:00. - HB 1168 – Relief: Provides 10 mills of relief through school funding formula. Reform: 3% cap on property tax dollars. Allows carryover of unused cap to next year. Allows counties to exceed the cap with a 60% vote in a regular or special election.

- HB 1534 – Reform: 3% cap on taxable values, allows to exceed % with a vote.

- HB 1575 – Relief: Reduces tax rates for residential, agricultural, and commercial. Reform: 3% cap on taxable values. Cap can be exceeded by a defined % with approval by the voters.

- SB 2363 – Relief: 60 mill reduction for residential, commercial and centrally assessed, 30 mill reduction for agriculture land using school funding formula.

- SB 2378 – Reform: CPI cap, can be exceeded by defined % with voter approval of two-thirds qualified electors. No committee action yet.

Click here to see a status report of the property tax relief and reform measures.

Other important legislative highlights from the week:

- SB 2201: Property Tax relief related – retroactive to allow for trusts to receive Primary Residence Credit – FINAL PASSAGE

- HB 1382: Increases gas tax 3 cents for counties, cities & townships – was defeated on house floor, reconsidered and passed – rereferred to Appropriations

- HCR3012: Resolution to put on ballot repeal of one mill for state medical center – FAILED

- HB 1602: Allows political subs to opt out of NDPERS defined contribution plan – Do Pass recommendation – expect this on the House floor Monday,

- HB 1213: $50 million in Infrastructure Revolving Loan Fund for Jail Improvements – PASSED

- HB 1197: Amended to study jail needs – PASSED

- HB 1306: Expanded free hours allowed for open records requests – Do Not Pass recommendation

- HB 1193: Law Enforcement Grants amended in House Appropriations to mirror Back the Blue grants from 2023 Session for local law enforcement & corrections officers – Do Pass Recommendation

Public Health Day at the Capitol

SACCHO local public health members teamed up with the North Dakota Public Health Association (NDPHA) and the North Dakota Department of Health and Human Services (NDHHS) partners for Public Health Day at the Legislature. Held in the Capitol’s Memorial and Legislative Halls, the event showcased public health initiatives, and the work public health professionals do to protect and improve the health of North Dakota communities. Public health trivia and Plinko were among the activities enjoyed by Legislators.

Local Government Capitol Connection THIS WEEK!

There is still time to register for the upcoming Local Government Capitol Connection Feb. 18-19th at the Bismarck Event Center. NDACo is partnering with other associations representing cities, townships, schools and parks to bring all local political sub leaders together for legislative updates. We hope to see you there! Click here for more information.