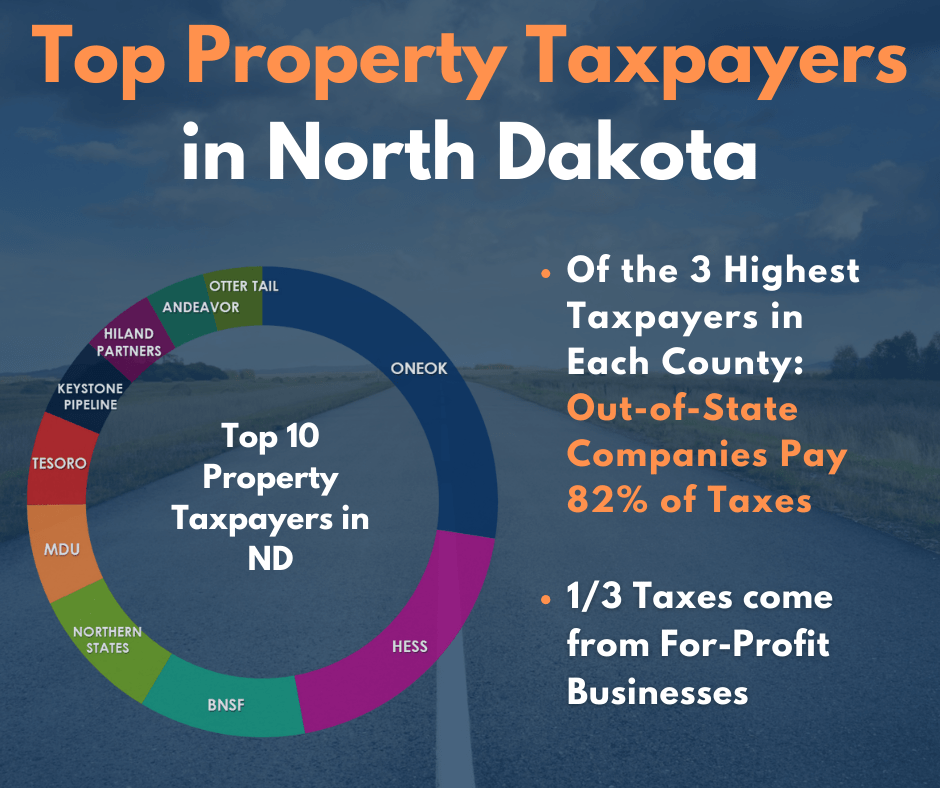

The North Dakota Association of Counties conducted research on the top 3 property taxpayers in each county. The findings are very informative. Here’s a summary:

- Of the 3 highest paying taxpayers in each county: Out-of-State companies pay 82% of the taxes.

- 77% of the 3 highest paying taxpayers are out-of-state companies.

- The 3 highest paying taxpayers in each county pay $90 million in taxes.

- The highest 3 taxpayers pay as much as 35.5% of all taxes billed (Oliver) to less than 2% (Cass).

Click to view a list of the Top 3 Taxpayers in each county

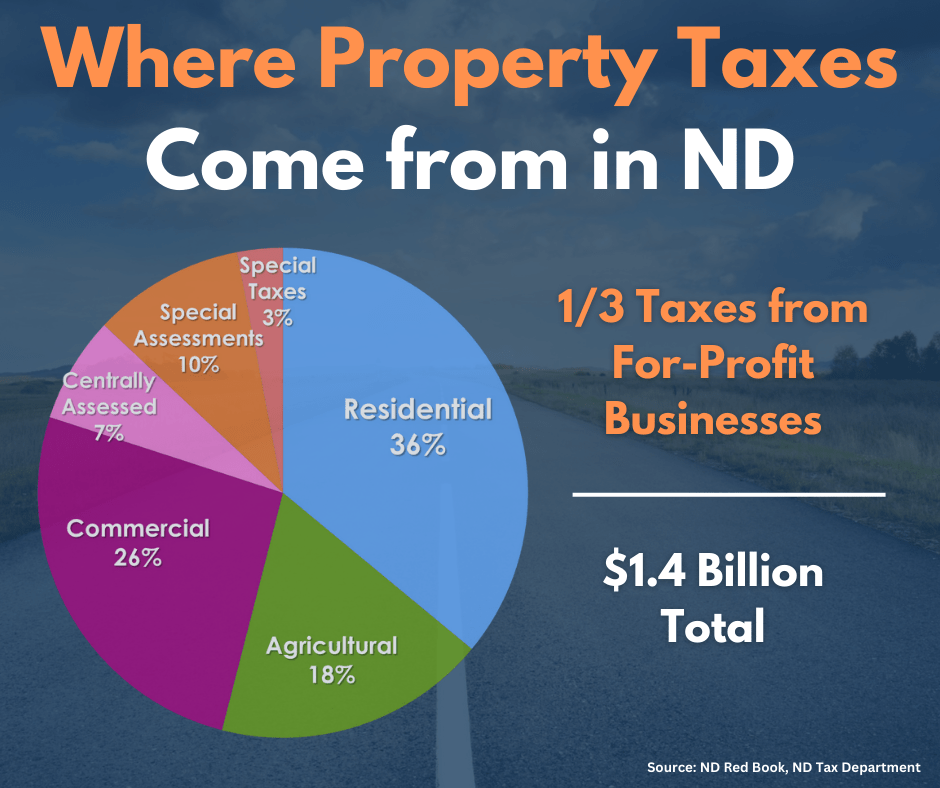

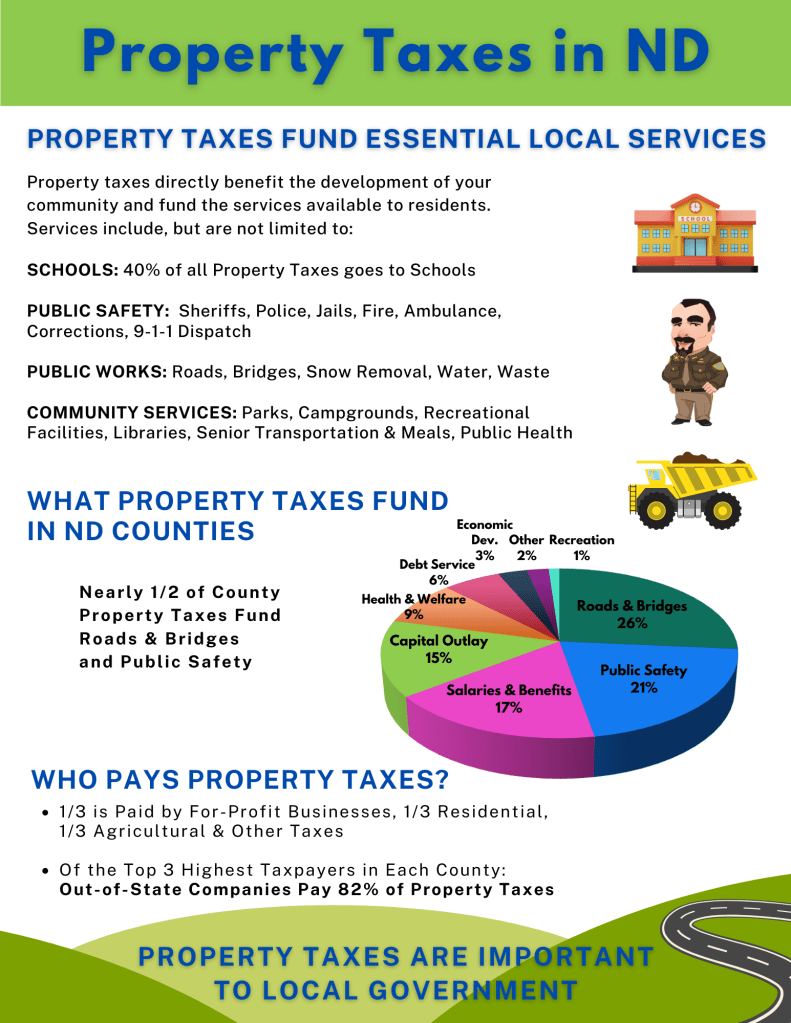

These points highlight who the real winners are if property taxes are eliminated. The measure goes far beyond providing property tax relief to North Dakota homeowners. In fact, only 36% of property taxes come from residential properties. Homeowners pay $513 million a year in property taxes or 36% of the total. Commercial and Centrally Assessed combined pay $459 million a year or 33% of the total. The other third of property taxes are paid by Agricultural, Special Assessments and Special Taxes. Bottom line, if the measure passes, big businesses – which a majority are out-of-state – will realize a tax break at the expense of North Dakota residents.

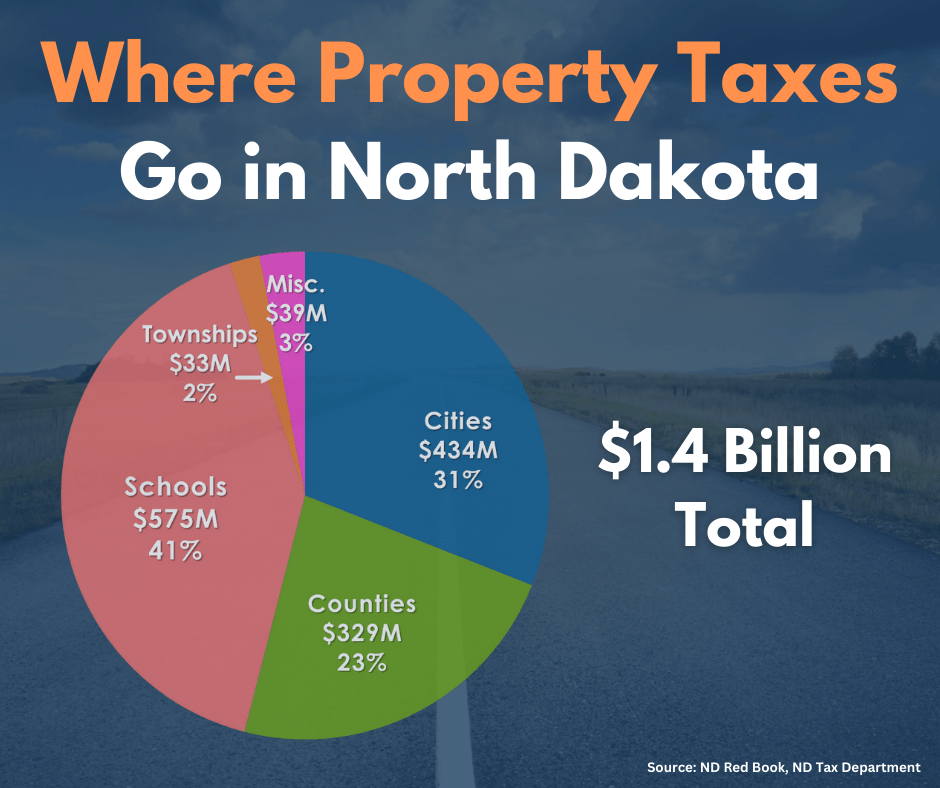

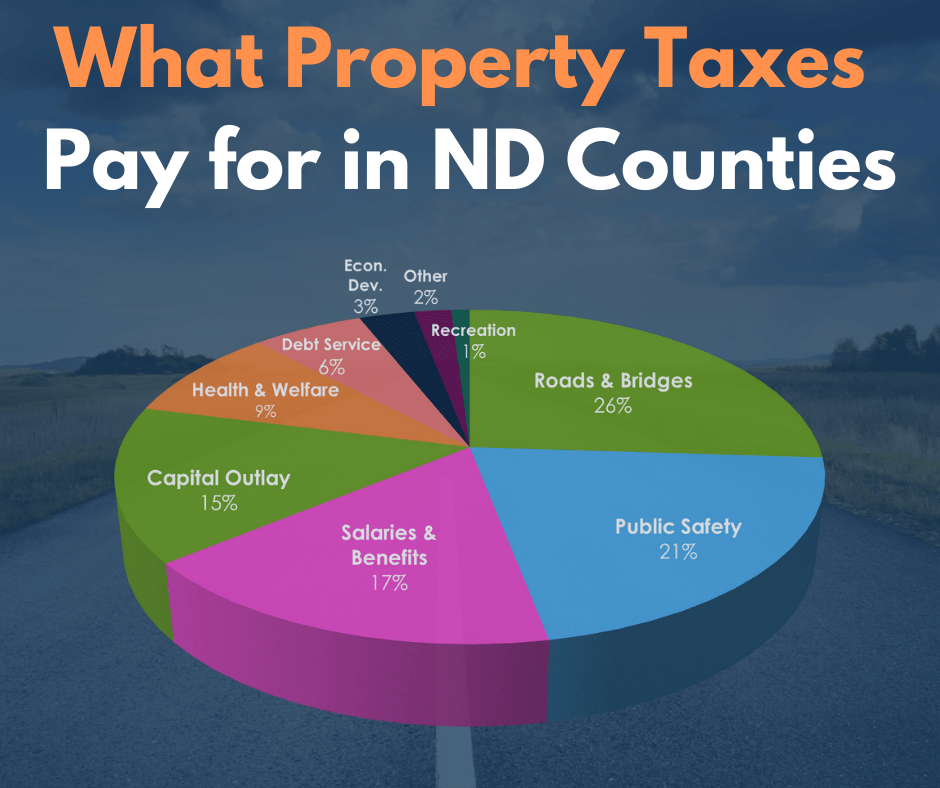

Statewide, counties collect 23% of the total $1.4 billion in property taxes every year. Nearly half of those funds are dedicated to roads and bridges and law enforcement. In addition, counties on average cut property taxes 1.2% in 2022.

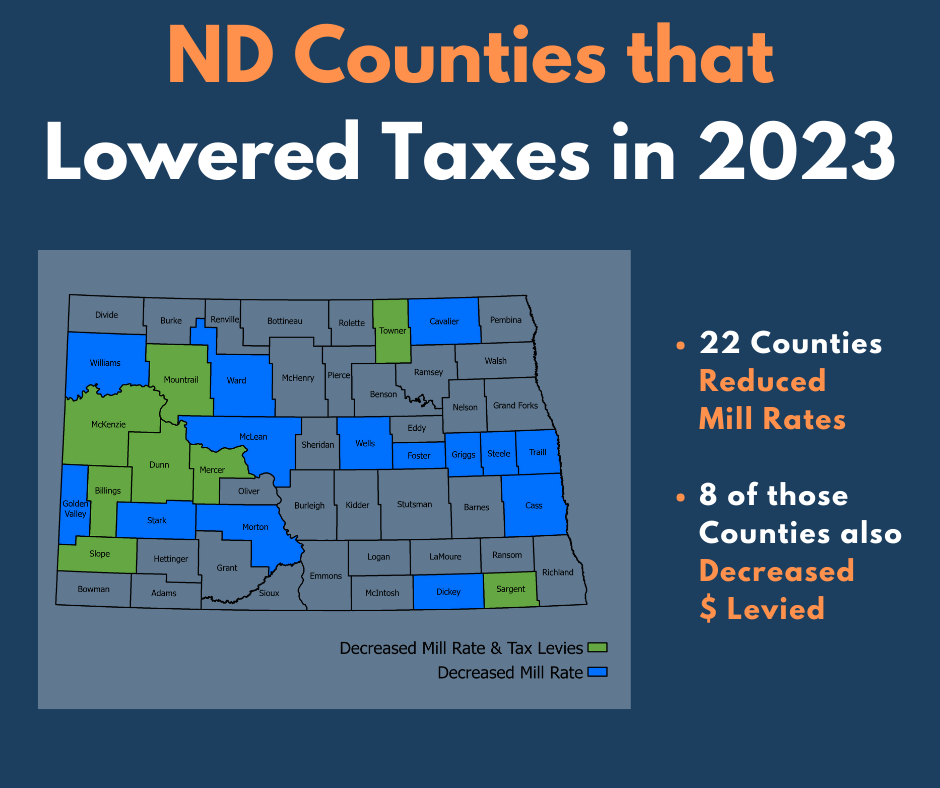

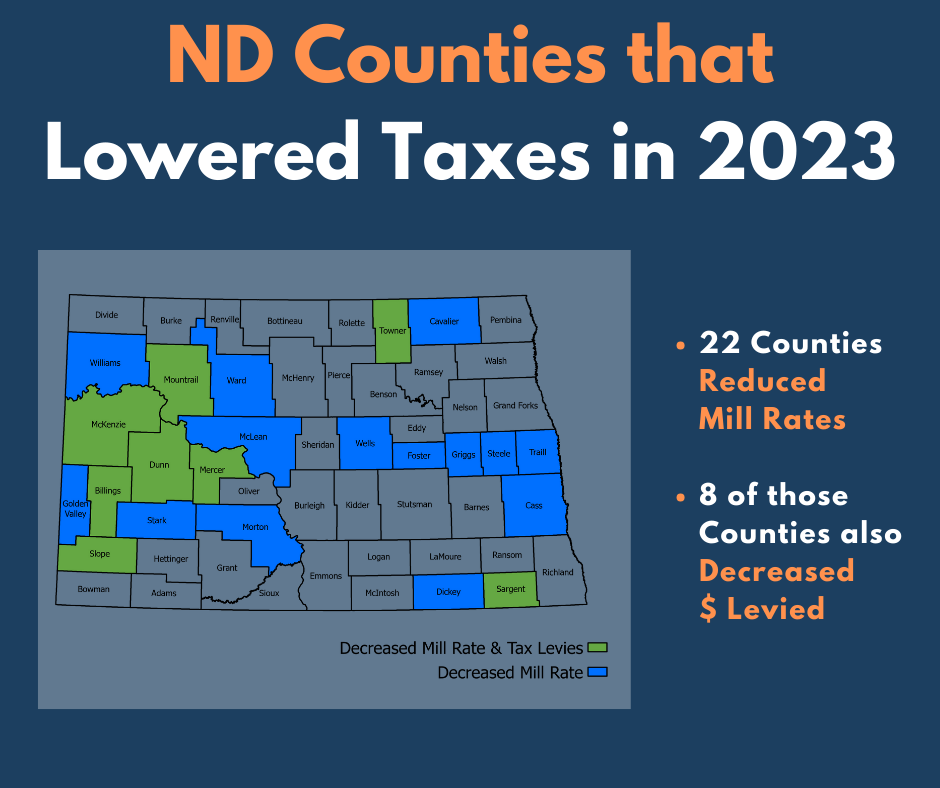

New analysis also shows that from 2022 to 2023, 22 counties reduced their mill rate and eight of those counties also decreased the dollar amount levied. This is great news and illustrates how counties are being responsible with their budgeting and addressing the needs of their communities.

Counties recognize the frustration many residents have with property taxes; however, they are necessary. Property taxes are controlled and spent where they are raised and fund vital services that benefit property owners. The Tax Foundation’s 2024 annual analysis of tax structures in the U.S. ranked North Dakota 7th best in property taxes. If the measure would pass, North Dakota would be the first state without property taxes. The estimated cost of this plan is $3.15 billion a biennium. That is half of the state’s general fund budget. This means lawmakers will more than likely cut other state programs, many that benefit local communities like state support for local roads, schools and senior programs.

Measure 4 requires the state to fund local governments based on property taxes collected in 2024…forever. There is no plan for growth or inflation. No county can build and maintain roads at 2024 levels or operate the Sheriff’s Department five years from now at today’s cost. Same goes for any of the political subdivisions providing local services.

There are many discussions occurring on how to further relief and reform. NDACo is willing to work together with legislators to find solutions that strike the right balance of allowing local control and funding local services, while addressing effective limits.

NDACo has developed a package of resources for counties to use in education on property taxes. Click here to view the informational documents.