CLICK to VIEW HEARING SCHEDULE FOR FEB 6-10

The discussion of “buckets” was a hot topic again this week, and will undoubtedly be hot to the bitter end. SB2367, sponsored by the majority leaders and the appropriations chairs, was heard Monday by the Senate Finance & Taxation Committee. It was characterized as being in competition to Senator Wanzek’s bucket bill (SB2275) heard last week. SB2275 simply eliminates the $400 million strategic Infrastructure and improvements fund (SIIF) which currently sits ahead of the Prairie Dog bucket and was strongly supported by counties, cities, townships and airports. SB2367, by contrast, keeps the current buckets in place and increases the total dollars by $150 million in four of the seven buckets that sit ahead of the prairie dog bucket – clearly a change in direction. SB2367 adds $30 million into the two $200 million state general fund buckets, $30 million to the $200 million tax relief fund bucket, and $60 million to the $400 million SIIF. While a proposed $30 million increase in the tax relief bucket is possibly a plus, since this bucket was created to fund the human service zones, there is no requirement that the funds be used in this manner. The committee voted to recommend a Do Pass and Rereferral of SB2367 to the Appropriations Committee, but retained SB2275 for further consideration as there is certainly interest in the committee for addressing counties and township infrastructure. Clearly a complex discussion that will take the next three months to resolve.

Several property tax bills were heard this week that proposed a freeze or cap on valuations, mills or budgets. SB 2357 provides a refundable income tax credit up to a maximum of $1000 per household. The credit is calculated using 10% of the property tax on a primary residence. NDACo opposed SB 2361 which freezes the valuation of a primary residence until the claimant no longer owns the property. Freezing valuations for one class of property shifts the tax burden to the other property classes and conflicts with the constitutional requirement to equalize property taxes across all property classes. SB 2387 rolls property values back to 2019 for primary residences and ag land, and limits their value increases to 2% or the consumer price index, whichever is less, unless the property has been improved or sold. NDACo expressed opposition to the value caps proposed in this 16 page bill. HB 1461 proposes a 5% cap on dollars levied over the previous budget year unless approved by 65% of the voters. Voter approval would be authorized for just one year at a time. NDACo opposed the 5% levy cap which prohibits local government from the ability to decide how to adequately fund the needs in their communities. Annual elections would be difficult to administer if not impossible given the current budget and property tax calendar constraints.

The hearing on SB 2277, the bill to move clerks of court to state employment, was continued from last week to allow Chief Justice Jon Jenson testify in support. NDACo Executive Director, Aaron Birst provided opposing testimony, urging an interim study before implementation. The Committee did not take action, but as it includes a $12 million appropriation to make this move, the bill must be addressed and rereferred to Appropriations.

There was a lot of activity on election related legislation in the House this week. A bill worked on by the previous and current Secretaries of State to clarify voting statutes and supported by county auditors, (HB1192) was passed. Two election related bills county auditors opposed were defeated in the House. They include: HB 1314, prohibiting county use of ballot drop boxes and HB1405, requiring counties to only use printed pollbooks on election day. The House passed HB1431 to require voters without adequate documentation of citizenship to cast a provisional ballot that will be counted if proof can be provided before canvassing. The Senate passed unanimously an County Auditor requested bill (SB2292) that provides better guidance for the behavior of “election observers.”

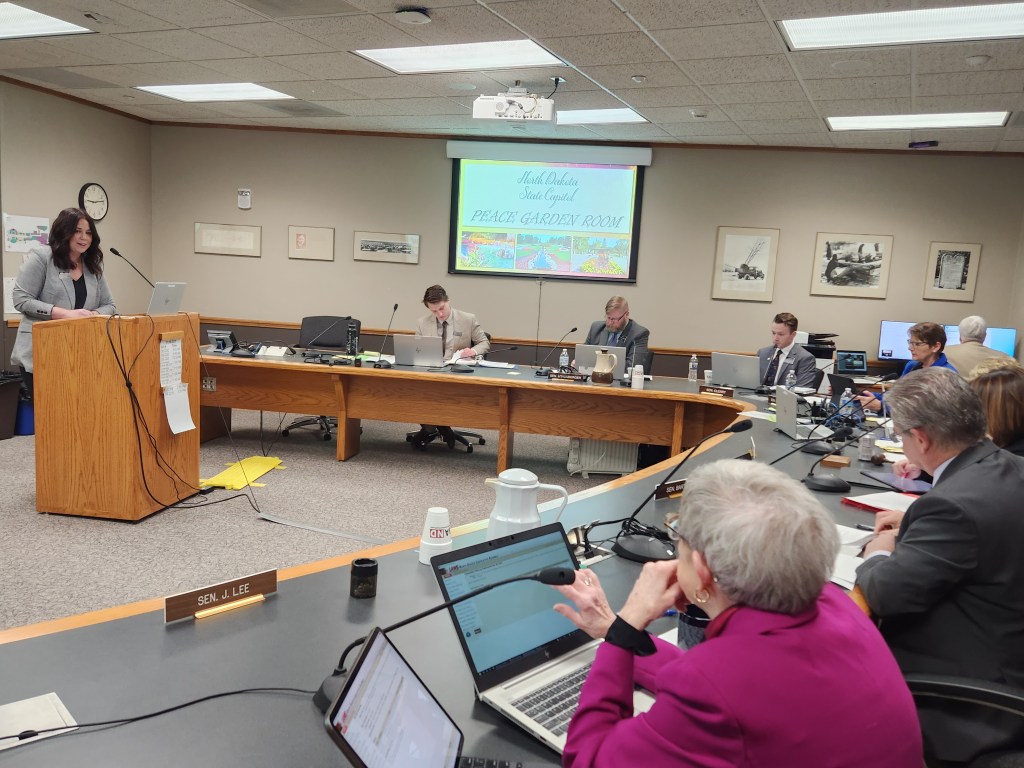

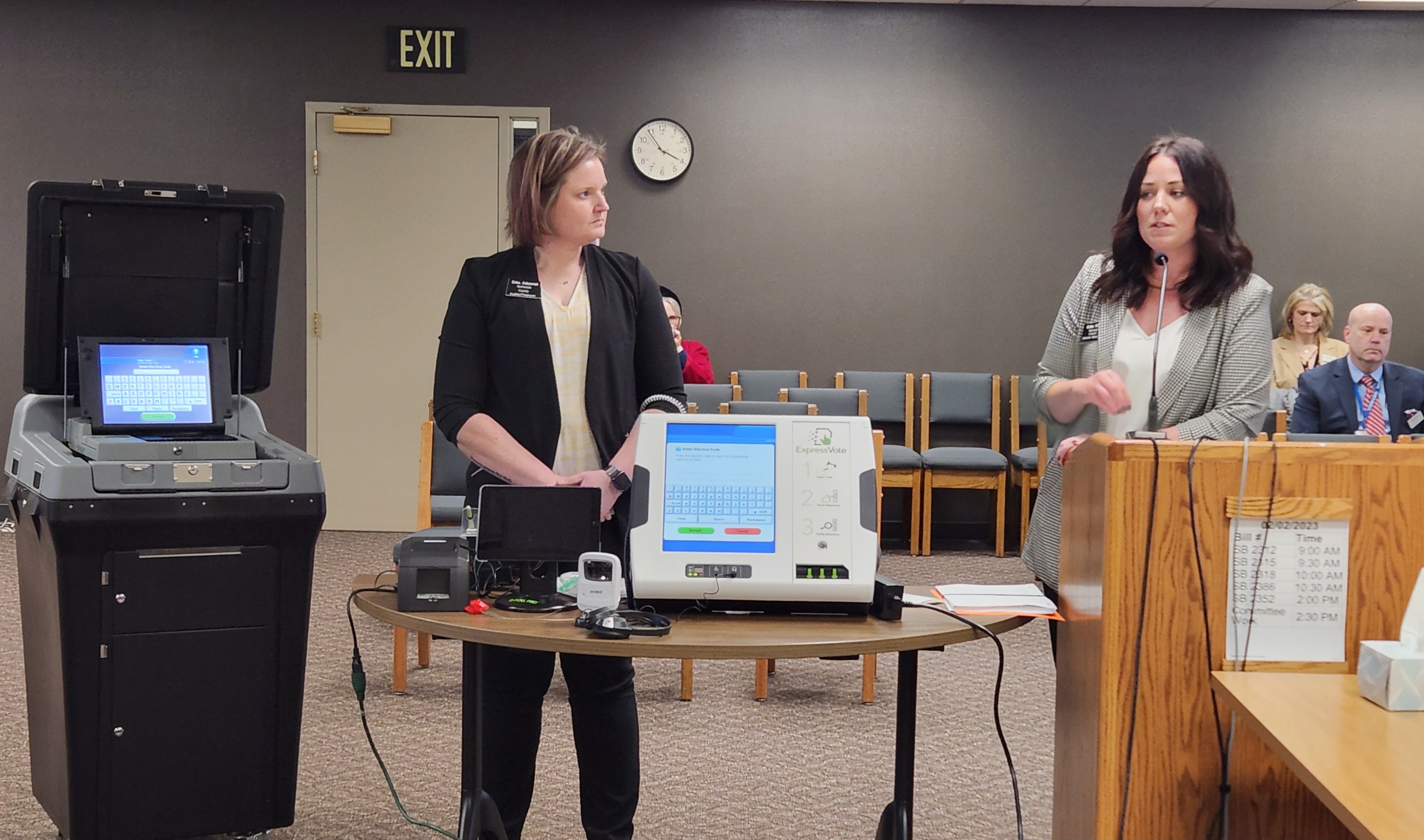

NDACo organized a demonstration of election equipment and an explanation of the election process to lawmakers as there are 35 election related bills being heard this legislative session. McKenzie County Auditor/Treasurer and Burleigh County Election Manager Erika White provided the educational session to the Senate State and Local Government Committee. We brought in election equipment to show the committee and explain the checks and balances in place illustrate the integrity of the election process.

Public safety issues also saw considerable action. The House approved HB 1279 to change the WSI presumptive coverage of law enforcement cardiac events after five years of employment regardless of where that employment occurred. This bill is being fast tracked and had a hearing in the Senate Thursday afternoon as well. The Senate unanimously passed SB2169 to increase the traffic fines for those convicted of those traffic offense three or more times prior. The Senate also approved SB 2168 which increases the fines for excessive speeds. SB 2107, which increases penalties for violent crimes and drug crimes where a firearm is involved. The Senate Judiciary Committee gave the Attorney General’s bill a Do Not Pass recommendation in the Senate Judiciary committee and will be voted on in the Senate next week.

NDACo’s Donnell Preskey and Golden Valley County Sheriff Dey Muckle testified to House Appropriations on the importance of HB 1307 which will provide $5 million to local law enforcement for recruitment and retention. Amendments were presented that would allow for the funding to be directly distributed to Sheriff and Police agencies for them to utilize for hiring or retention bonuses. If approved, this would be one-time funding.

HB1164 which sought to expand the medical marijuana program to permit edible products was quite soundly defeated in the House 20-72, while drinking when pedaling a pedal-bar was supported by House 85-7. Allowing the riding of a horse (or pedaling your own bike) while intoxicated (HB1506) was heard this week as well, but no action to report at this time.

All 94 House members supported HB1292 to add recreational projects to the list of eligible activities for the infrastructure loan program.

The Senate addressed the state rates for meal reimbursement while traveling on government business. SB2124 was introduced at a fixed amount, moving the total from $35/day to $42/day. The State and Local Government Committee amended the bill to index the rate to 90% of the federal GSA rate for ND (like lodging). The amendment failed on the Senate floor, so the bill goes to Appropriations in its original form as this will obviously have considerable impact on every agency budget.

On the agriculture front, the return of the beehive setback bill (SB2134) wasn’t considered very sweet, as it garnered only 2 votes on the Senate floor. While the House turned the issue of property tax exemptions for potato/grain storage buildings in cities into a study, the Senate approved (on a very strong 42-5 vote) this exemption in an amended version of SB2279. The annual application to the county was removed, and the list of “family members” allowed to store farm products was expanded in the amendments. The “model feedlot zoning” bill, HB1423, received considerable testimony, both for and against. NDIRFCEO Brennan Quintus spoke against singling out NDIRF coverage in the bill, and there seemed to be a bit of disagreement between the Ag Dept. and the Dept. of Environmental Quality regarding roles. If this bill is to pass, it appears to need some work..

Public health hearings this week heard topics from past legislative sessions including onsite septic systems. The 2021 Legislature created an Onsite Wastewater Recycling Technical Committee (OWRTC) which met frequently throughout the interim. While the Committee has made good progress, the Committee composition continues to be debated as it was established with gubernatorial appointments of four installers, three local public health representatives and a licensed environmental health practitioner nominated from a professional onsite wastewater recycling association. SB 2256 seeks to balance the Committee by adding an additional licensed environmental health practitioner from the local public health units and one representative from the Department of Environmental Quality. Local public health units provided testimony supporting this bill. The subject was also part of SB 2253 introduced earlier in the week which included several changes to the OWRTC responsibilities as established. Replacement of Committee members to five licensees effective August 1, 2024 was among many of the revisions. Senate Industry and Business Chair Doug Larsen requested that installers and local public health representatives meet with Dave Glatt, Director of the Department of Environmental Quality, to discuss the possibility of combining the bills. Further hearings regarding the issue are expected next week.

The House passed HB 1412, which will label electronic nicotine delivery systems as tobacco products in North Dakota statute. The bill would also require retailers selling these products to have a tobacco retailer license, allowing the establishment of compliance check regulations. HB 1357 restricting tobacco products from internet sales failed in the House.